An ADX Breakout Strategy for ES and NQ

This strategy originated from a YouTube video. There are two variations, a 30-minute (free!) strategy written in PineScript, and a daily version for RealTest (for paid subscribers).

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

One of the members of the Signal chat group sent me a link to a simple strategy on YouTube. After watching it, I thought, "I'm pretty sure I could code that in ten minutes." So, I decided to test that assessment. I was mostly right. This strategy is dead simple. The extra minutes I needed were spent figuring out how to script a simple stop loss in PineScript. In the end, though, I am happy enough with the script that I wanted to see if it would work on a daily time frame too. So, I created a version of this strategy in RealTest as well.

Today, I am going to share both of those strategies. The PineScript version will be available to all subscribers, along with the strategy logic. You can also watch the video to get the strategy logic and whatever platform language they use in the video. I think it's EasyLanguage.

The code for the PineScript version can be found on my TradingView scripts page:

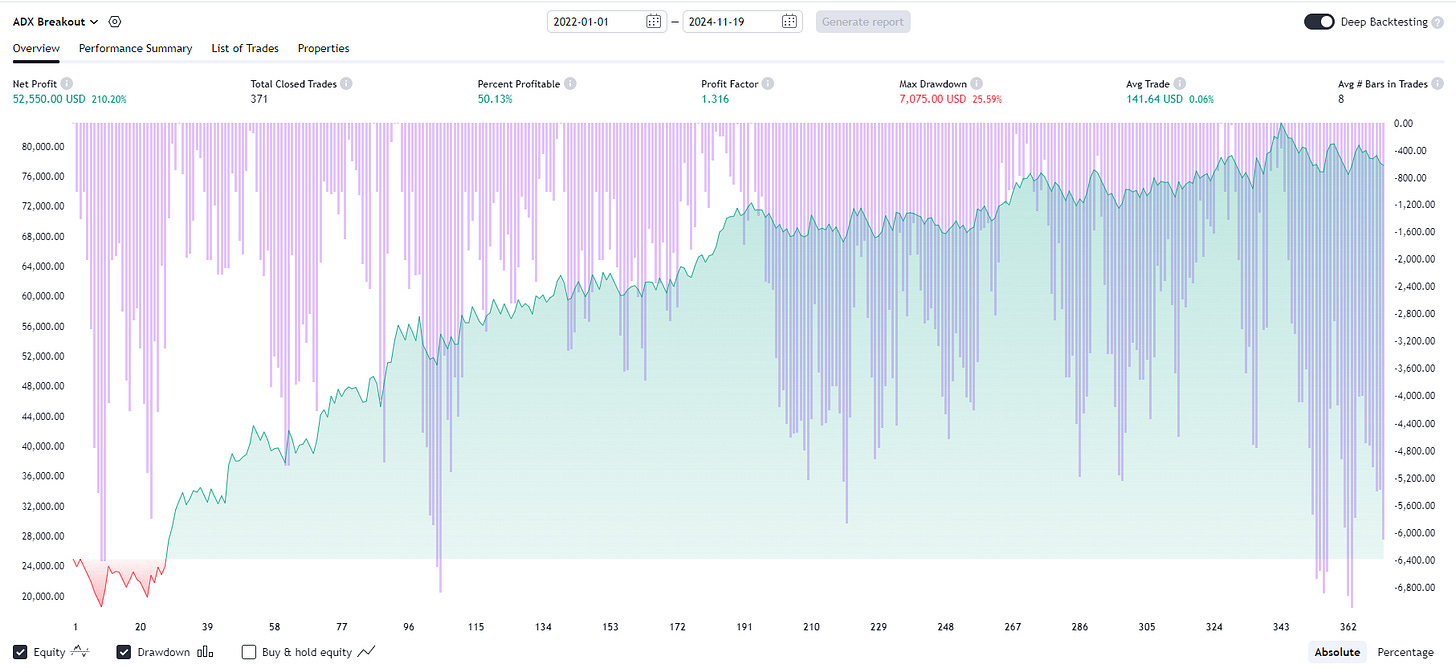

Pine Script Results

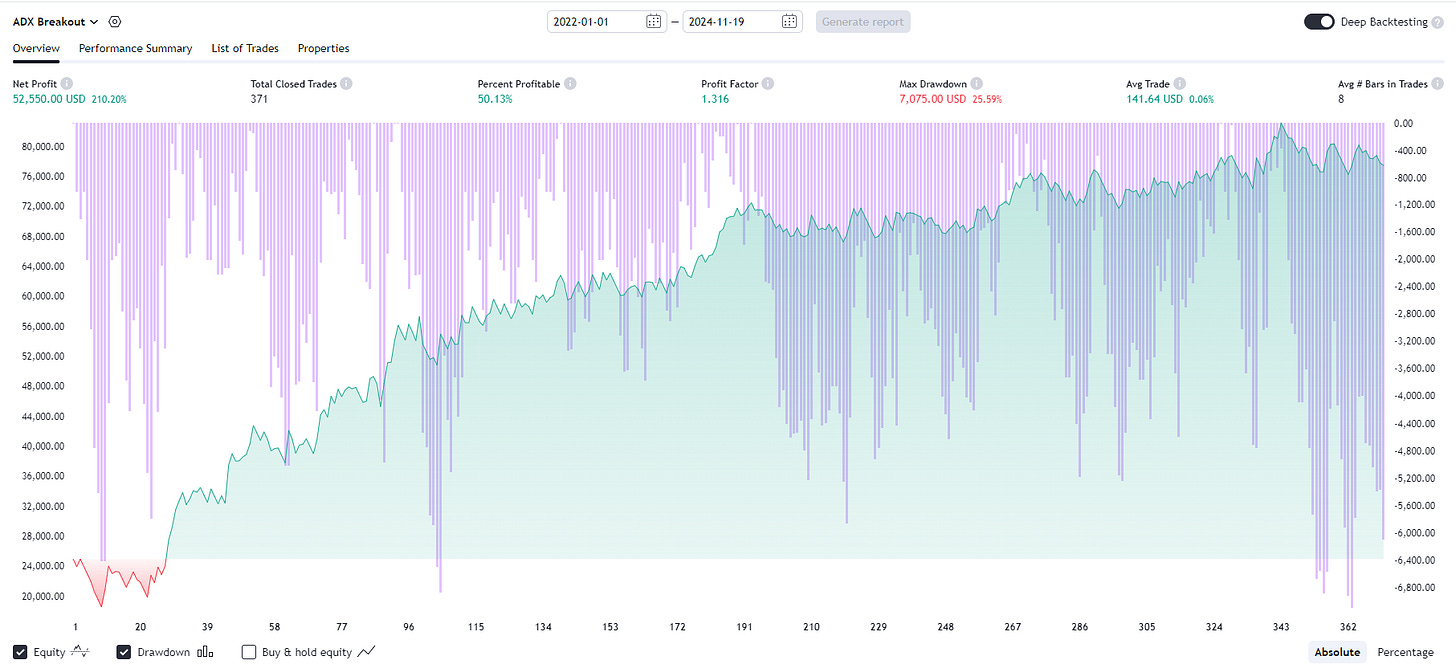

RealTest Results

Logic

This is a simple breakout strategy that uses the ADX to help determine if a new trend is getting ready to start. It is a long only strategy for ES/NQ.

Entry Rules

Initiate a long position in IWM when all the following conditions are met:

ADX: ADX < 17.5

Breakout: Price is higher that the highest close of the last 34 bars.

Session Window: Trades only between 0800 and 1500 (central time).

Exit Rules

End of Day: Exit the position at the end of the day (or the end of the trading window)

Stop Loss: Exit if stop loss is hit.

RealTest Code

The rest of this post is for paid subscribers. Paid subscribers will have access to all paid publications, strategies, code associated with posts, and access to the HGT chat room. Red Team members will have access to the community GitHub and more.