Strategy 1 -- A simple trading strategy for manual or automated trading

This strategy only uses two indicators, has no optimization, and has a profit factor of 5.9 with a profit of $13k on one ES contract in out-of-sample testing (2024).

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

The first strategy (sans ATS) is finally here, and it’s a dead simple one. Using just two of the indicators from the previous articles, we will create a simple trading strategy that can be used in an automated trading system or with manual trading. Want to know something else cool? This strategy is not going to be backtested on QuantConnect or NinjaTrader.

Today, we will look at the results of this backtest on TradingView. Why the change? There are a couple of reasons, really. QuantConnect has a large learning curve, and I don’t feel I completely understand the framework just yet. I am also fairly dissatisfied (understatement) with using a cloud-based development environment. I am so annoyed with it that I am unsure if I still think the amount of free data it comes with is worth it.

What can I say? I like my development environment to be smooth and silky, like a crème brûlée. The kind of smooth that would make a French pastry chef blush. R-rated smooth. Elevated (uh-huh) and decadent. I’m not there yet, with my local environment and skill, but I already know that a cloud-based solution will certainly not get me there. If I ever expect to master the keyboard (like The Primeagen), I’m going to need to do it on my own machine.

I have also been getting my ass handed to me at my full-time job (being a dad) for the past two weeks or so. My son is in a sleep regression period (he has decided he only wants to fall asleep if he is being held) and doesn’t want to nap or stay asleep through the night. We also took our first trip down to the local ER after he managed to pop open a baby gate and take a trip down the stairs in a walker device (roller coaster style). I’m pretty sure that I was actually the patient during this visit. Years of field assessment training and a solid working knowledge of traumatic (and head) injuries didn’t stop me from taking the trip to the ER. At least I didn’t bother the local EMS, but I was sure as hell thinking about it.

In this post, we will cover the strategy criteria, provide the code used for testing the strategy in TradingView, and discuss how this strategy can be utilized for manual trading and considerations for turning it into an automated strategy. The strategy criteria can be used on any trading platform you want. Paid subscribers, if you need a hand with adapting this strategy to your trading platform of choice, reach out, and I will see what I can do to help.

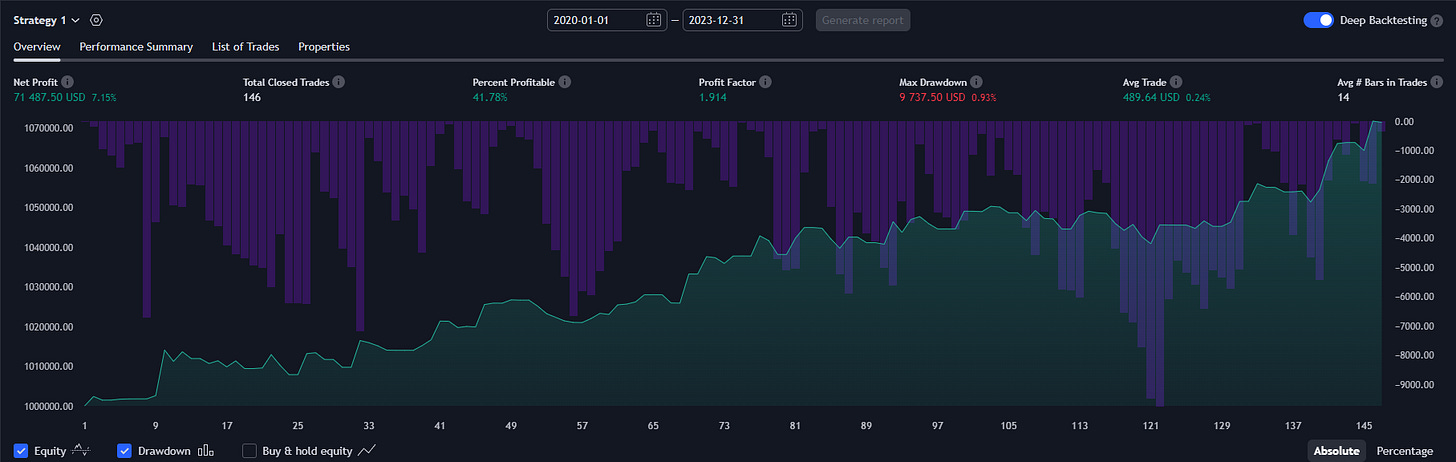

Before we discuss the strategy details, here are the results from the testing. Remember that this test was done using the TradingView platform. I tested and coded the strategy using data from 2020 to 2023 as the in-sample group and then performed a backtest on data from this year (2024) as our out-of-sample data. All tests were performed on an ES 4-hour chart.

In-sample results:

Out-of-sample results:

This strategy has a very simple exit criteria that could use some improving, but the purpose of this test wasn’t to try and make a completed automated strategy. Instead, my goal here was to test the entry criteria itself based off of that we received in the previous posts researching the indicators. It is also important to note that I did not optimize any of the entry criteria for this strategy.

Let’s break down the criteria and go over the code I used to create this.

The rest of this post is for paid subscribers. Paid subscribers will have access to the private GitHub where all the Hunt Gather Code and strategies live. It is continuously being worked on and will expand as we explore the world of automated trade systems.