Strategy 16_IWM

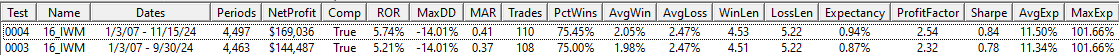

RTY long mean reversion using the CMMA. CAGR 5.21%, MaxDD -14.01%, 75% win rate, 2.32 profit factor, and 0.78 Sharpe.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

I recently received feedback from a subscriber expressing difficulties with the Close Minus Moving Average (CMMA) indicator. The CMMA is engineered to function as a highly sensitive mean reversion tool, capturing deviations between the closing price and a moving average. In its most straightforward implementation, the CMMA calculates the raw difference between the close and the moving average. However, the variant I have adapted from Timothy Masters' Statistically Sound Indicators employs a normalized approach, enhancing its accuracy. Allegedly.

Yes, it also works on other indexes or sectors. The picture below shows the results for IWN, SPY, and XLV.

This next photo shows the out-of-sample results.

Check out the report below for all the stats and graphs.

Strategy 16 Report

Strategy 16 Logic

The rest of this post is for paid subscribers. Paid subscribers will have access to all paid publications, strategies, code associated with posts, and access to the HGT chat room. Red Team members will have access to the community GitHub and more.