Strategy 20 – An equities and futures trading strategy

This strategy performs on ES/NQ and stocks/ETFs. The lowest profit factor is 2.28 and the lowest accuracy percentage is 60%. Check it out if you trade equity futures or equities.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

I got sidetracked with trading and working on building multi-strategy portfolios this week and almost missed my deadline for the week. But that is good news – it means this post is a strategy post (yay!), and there are more strategies in the pipeline (more yay!). I have a whole array of ideas that I plan to start implementing in 2025, and I will publish an update soon outlining our current status and the direction for the year ahead.

Until then, enjoy this week’s strategy.

This strategy is available in both a futures version (long and short trades) and an equities version (long only). It uses the close minus moving average (CMMA) for timing mean reversion entries and a simple SPX-based regime filter to help narrow down entry windows.

The futures version holds long positions overnight, averaging two-day holds, and closes short trades within the same day as day trades. It boasts a combined profit factor of 3.27, a Sharpe ratio of 1.03, and a 76.86% trade accuracy across 121 trades over the past 10 years.

The equities version exclusively takes long positions, holding them for an average of 70 bars. It achieves a profit factor of 6.58, a Sharpe ratio of 0.84, and a 64.71% trade accuracy across 17 trades in the last decade.

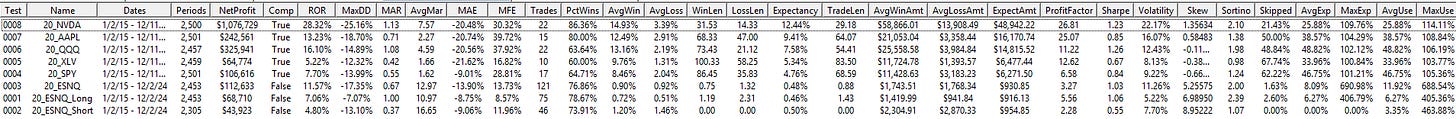

Below, you’ll find a couple of screenshots for Strategy 20. One shows the test results up to the end of this week (12/13), and the other includes snapshots of earlier results from this month, along with additional assets demonstrating that the SPY version of the strategy performs well on instruments beyond SPY.

Results as of this writing:

Results of different instruments:

This strategy is another straightforward approach that utilizes a regime filter and a single indicator to time entries. As we approach the end of 2024, we have 2–3 more strategies to release before the year concludes. If I find my rhythm, we might even reach strategy 24, averaging two strategies per month despite the late start in strategy development this year. Strategy 1 was launched in May.

Remember, paid subscribers have access to all premium and archived posts, as well as the Substack chat room. Red Team subscribers additionally gain access to GitHub and the Signal chat for those interested. GitHub access provides early access to strategies and Python code, as it serves as the repository for all our resources. Subscribe below if you’d like to become a member.

Strategy 20 Logic

The rest of this post is for paid subscribers. Paid subscribers will have access to all paid publications, strategies, code associated with posts, and access to the HGT chat room. Red Team members will have access to the community GitHub and more.