Strategy 25_ES -- Same concept as 24 but with a twist

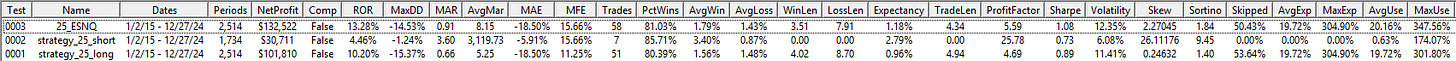

Similar to 24, we use a single indicator and VIX to time entries. 13% CAGR, -14.5% MaxDD, 81% win rate, 5.5 profit factor, 1.08 Sharpe.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

I got a little silly with this one. It is the same concept from Strategy 24, but I combine the ZLMA (zero-lag moving average) indicator into the CMMA (close minus moving average) to see if we can generate reversion signals that are a little more reactive to recent price action. Guess what? It seemed to work.

This is the last post of the year. Next month we cut back the strategies to 2 a month and start shifting focus back to studying algorithmic trading and improving our research game. This has been an outstanding year for HGT (self-proclaimed) and I have all my readers to thank for it. So, thank you. Seriously. It means a lot to me when you read my posts and every subscriber helps keep me at home with my kid and not on the back of an ambulance or overseas in a conflict zone.

Strategy 25 Results

Summary Stats:

Report: Strategy 25_ES

Logic

The rest of this post is for paid subscribers. Paid subscribers will have access to all paid publications, strategies, code associated with posts, and access to the HGT chat room. Red Team members will have access to the community GitHub and more.