Strategy 4c — Unf***ing some mistakes from the last one.

A reader pointed out two things wrong with the previous variation of strategy 4. I addressed those issues, and our performance is now ROR 39.5%, PF 2.25, Sharpe 1.8, NP $110k, and MaxDD -7%.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

This post will be brief; there will be no lessons this time. I know, bummer. Instead, I will talk about what I missed in the last strategy and how I fixed it. Of course, some of this post will only be visible for paid subscribers. That’s life, though. I really enjoy being able to research these topics and try and provide newer traders (cause I sure as hell ain’t no expert) a better understanding of the world they are trying to play games in. Like most games worth playing in life, you have to pay to play. At least on Substack, you can choose who you are willing to help support. One day, I hope to be able to get your support, too! Remember, your support helps me keep this going, and it helps keep me close to my toddler. Without this outlet, I would be another knuckle dragger working overseas, missing all the important moments in my family’s life.

Now that sappy Larry has had his moment, let’s get into it.

Mistakes

One of the HGT readers brought to my attention two crucial issues with the previous strategy I posted. Your feedback is invaluable and plays a significant role in refining our strategies. I am always open to questions or criticism. I am always willing to admit when I fuck up.

First, the strategy did not take survivorship bias into consideration. This isn't a new concept to me, but it didn't stop me from making one of the most basic mistakes we can make when backtesting a trading strategy. The original strategy used a stock universe that only considered assets that were currently trading, and none that were delisted. In my defense, I didn't think that would be that big of an issue since I was only testing back the last two years of data, but why chance it? The obvious mistakes that can be avoided and accounted for should ALWAYS be avoided and accounted for. There was no excuse for this, but it's all part of the learning process. So, I made sure the universe of stocks that I tested against in 4c considered previously listed stocks too.

Survivorship bias fixed. Moving on to the next mistake.

The next mistake was using fundamental data as a parameter for filtering stocks. The mistake was not that I used fundamental data (market capital) but that Norgate Data only provides the CURRENT fundamental data, not historical data. That makes the fundamental data almost entirely useless for backtesting purposes. The gap and go strategy, which also uses market cap, still works, as it is intended to generate trades for day traders looking to capitalize on stocks after big moves, but it does mean the backtest might be less than reliable and it still need to account for delisted stocks (fix coming in the future). Just depends on how often small (or smaller) cap stocks get more market capital. Since I wanted to test my strategy, I needed to find a different way to see if a stock was tradeable besides its market capital.

So, that's what I did. I removed the survivorship bias by ensuring my universe included delisted stocks, and I added a liquidity check that didn't use the market cap.

Here are the new backtest results.

Backtest Results

Just like last time, this was tested on RealTest using Norgate Data at a daily interval. Instead of being exactly two years of data, it starts on 01/01/2022. This is because I finally purchased data, so I am no longer confined to two years of data.

Strategy Stats

Combined Monthly Percent Gains

Equity

Drawdown

Daily Returns

Monthly Returns

Individual Gains

Monte Carlo — Equity

Monte Carlo — Drawdown

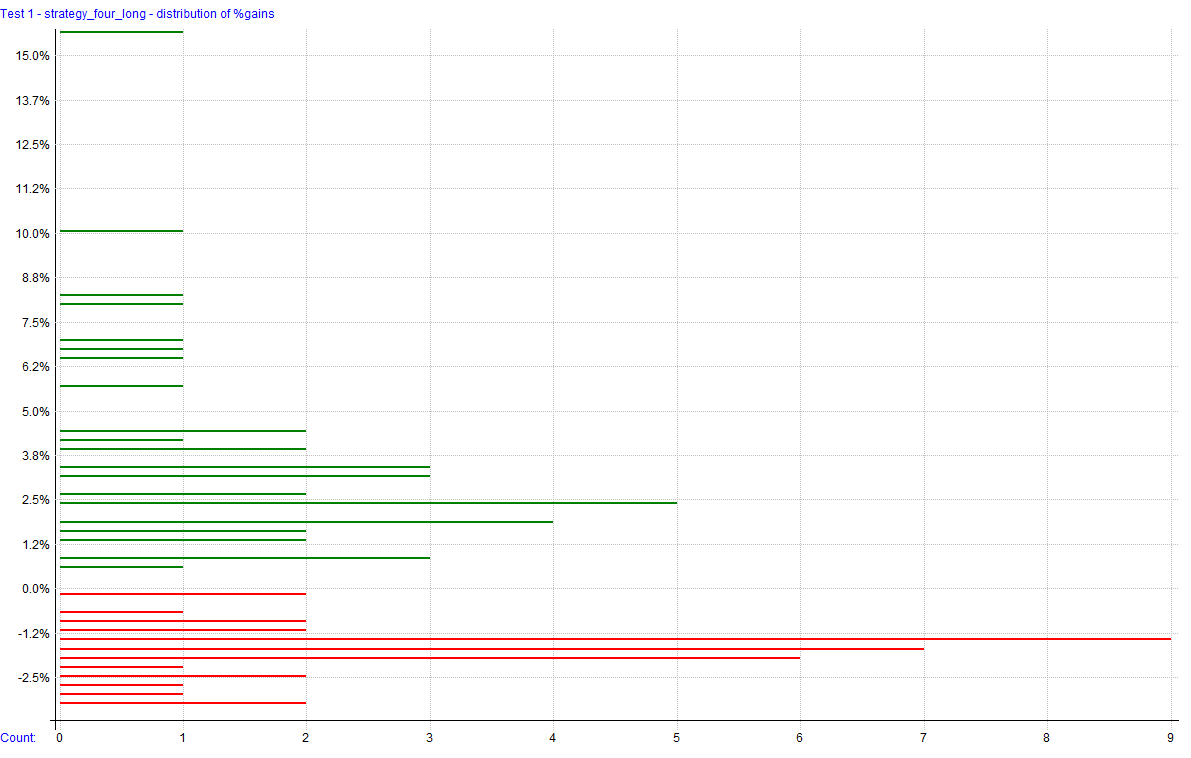

Distribution of Gains

Distribution of Excursions

Want to know how I addressed these issues and maintained similar results to the previous strategy? Become a paid subscriber today and gain access to everything. I am even thinking about making a Discord channel for all the HGT nerds to gather around and talk shit to each other… or discuss trading, quant research, and automated trade systems. Whatever the community wants, really. ;)

The rest of this post is for paid subscribers. Paid subscribers will have access to the private GitHub where all the Hunt gather Trade code and strategies live. It is continuously being worked and will expand as we explore the world of automated trade systems.