Strategy 6 gets updated -- It's probably still unrealistic, though.

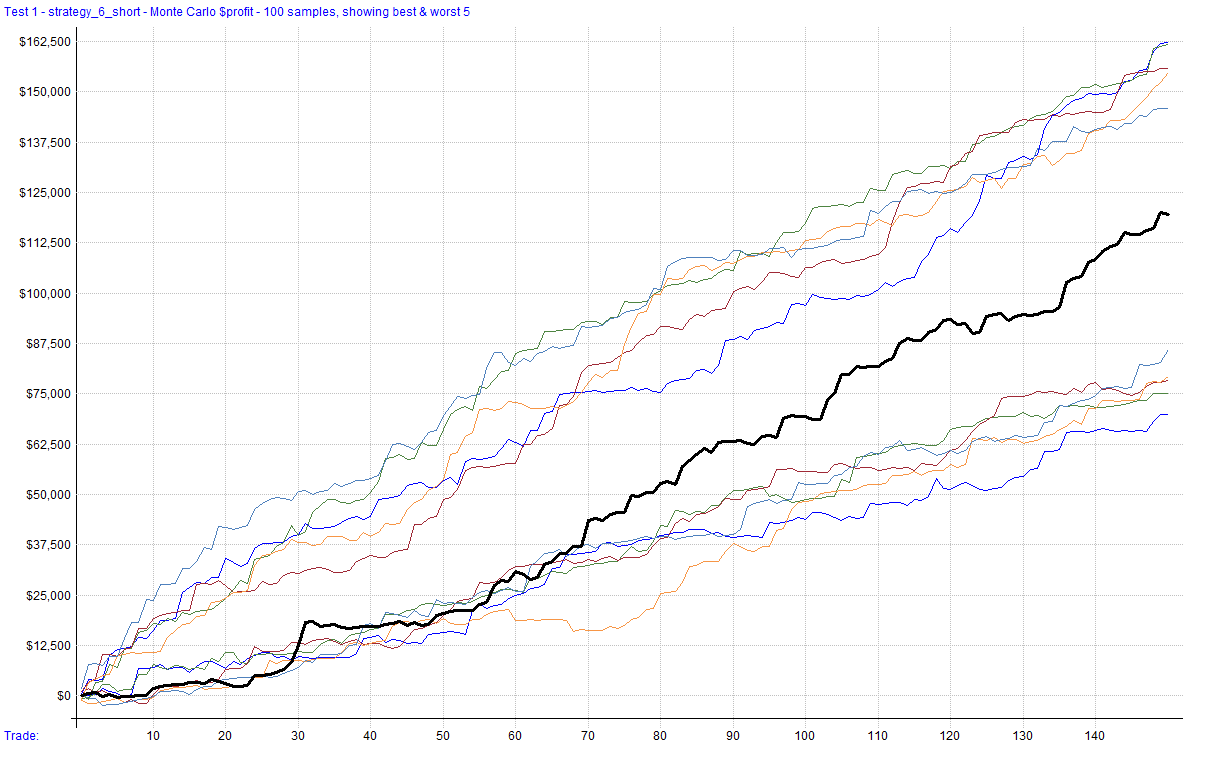

This strategy is now a short-only, mean reversion strategy that trades the Russell 2000. It boasts a profit factor of 6.5, a Sharpe of 1.82, 75% accuracy, a 47% ROR, and a MaxxDD of -20% in 10 years.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

A reader reached out to me and asked me a couple of questions about Strategy 6. When I went back and looked at it, I realized that they were right to ask questions. This strategy was one of the earlier ones, and thus didn't get updated as I learned better ways to script strategies. So, I decided to fix the issues and see if that strategy was still usable.

During this process, I discovered that the long variation of the strategy was lackluster. I removed it and focused on the short side of the strategy since it still showed promise. I corrected some of the main issues (ranking and checking index status) and adjusted some of the calculations to use more reliable measures (such as log returns). The strategy looks like it could be a promising addition to a portfolio looking for some short-term short exposure.

Check out the results. The strategy is capped at using 25k (the starting account balance) each time it makes a trade. Meaning, there is no compounding here. This is to help make it more realistic, because incredibly large short positions on these stocks are unlikely.

Important Notes about this Strategy:

This strategy is a short-term strategy that shorts instruments in the Russel 2000. I have had several people advise me that it is difficult to trade strategies like this (especially with EOD data and simple entries) and get the same results in the real world. I trust their advice, since they have history trading these types of strategies and I do not.

Russel 2000 stocks can be illiquid and difficult to short (not as many stocks available).

Lump sum limit entries will be difficult to fill during volatility spikes.

This version uses EOD data to get an idea about the efficacy of the idea. It makes the assumption that the entire position will get filled at the predetermined limit price should price hit that order. Because of this, and the aforementioned issues with shorting stocks in this index, this strategy is meant to be a framework for further investigation on an intraday chart. It would likely benefit from scaled, dynamic entries that take advantage of volatility spikes and liquidity.

I make my best effort to limit issues within the strategy criteria, but it should be understood that taken exactly as is, this strategy has some holes that I plan to try and address with an intraday platform (rapidly scaling into positions).

Strategy 6_RUT

This strategy is still the same concept as the original strategy 6, but with upgrades and dropping of the long variation. It uses volatility and overbought conditions to time short-term mean reversion opportunities in small cap, low price stocks. The concept is that these stocks will see heightened volatility short-term and then revert back to the mean. The goal is to capitalize on those days and short the stock after the move.

You will notice that this strategy does use a custom indicator in its calculations. I will attach that custom code here as well. This is just a custom ATR (average true range) that calculates either a regular ATR or log ATR with simple smoothing. Code is attached below. You can change this in the strategy if you wish to use a different version of ATR.

The rest of this post is for paid subscribers. Paid subscribers will have access to all paid publications, strategies, code associated with posts, and access to the HGT chat room. Red Team members will have access to the community GitHub and more.