Strategy 11 - Mean reversion, featuring the Stochastic indicator

Simple and efficient mean reversion strategy in two flavors. Both beat the QQQ buy and hold with no optimization.

Now that I have a subdomain to house reports, Strategy posts are going to get brief. I will list the summary stats of the strategy and provide links to the reports that have graphs etc. Then, I will jump into strategy logic and coding it for RealTest.

This strategy has two variations. One is a more traditional method of entering and exiting trades, the other is a dynamic sizing with routine rebalancing (like Strategy 9). Each has their advantages and might suit different traders/portfolios.

Summary Stats

11:

Compound Annual Return: 22.60%

Max Historical Drawdown: -27.12%

Average Holding Period: 7.29 Days

Expectancy Per Trade: 1.06%

Win Rate: 71.20%

Profit Factor: 1.58

Sharpe Ratio: 0.97

MAR Ratio: 0.83

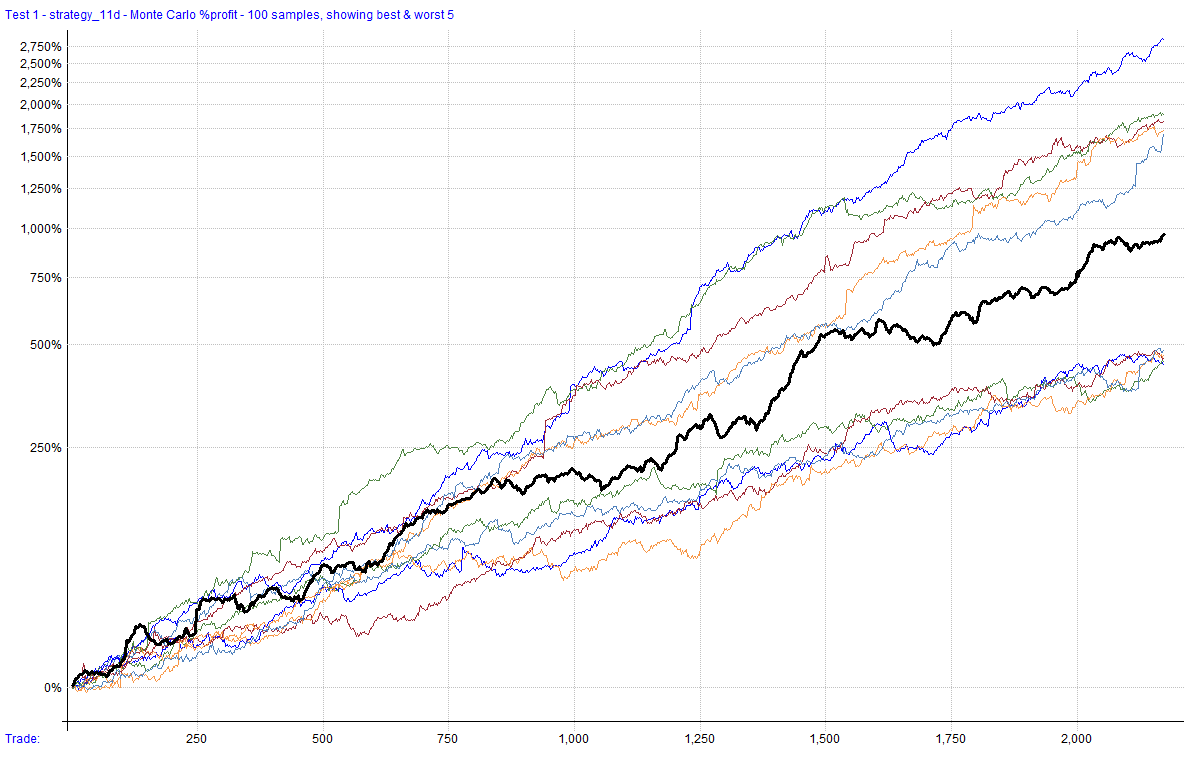

11D:

Compound Annual Return: 24.15%

Max Historical Drawdown: -14.70%

Average Holding Period: 6.43 Days

Expectancy Per Trade: 0.08%

Win Rate: 57.73%

Profit Factor: 1.60

Sharpe Ratio: 1.32

MAR Ratio: 1.64

Reports

Strategy 11 - The Logic

This strategy utilizes the stochastic indicator that was discussed here:

For this strategy, we use the twice-smoothed variation of the indicator with a 14-day lookback.