Strategy 2 – One indicator on a daily chart

Today’s strategy only uses 1 indicator and has a profit factor over 2.0 on multiple instruments tested.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

We’ve got another simple strategy today, and just like the title says, it uses a single indicator on a daily chart. The indicator we use today will be the third indicator we researched in recent articles, the Moving Average Convergence/Divergence (MACD) indicator. The purpose of this strategy, like Strategy 1, is to test the efficacy of the trade entry trigger.

Before we dive into it, I want to discuss why I am currently looking at long-only trade signals.

Several years ago, when I first started looking into day trading, I did what many people who started to get into day trading do. I shopped around for a course that would teach me what I needed to know to learn how to trade. Like many others, the training content I chose to use was Warrior Trading, a trading course (amongst other things) that was taught by Ross Cameron. I have nothing bad to say about those courses’ content or the associated community. While momentum stock trading did not vibe with me the way a more systematic and technical approach did, I did learn some good things from these courses.

One of the things that has stuck with me from those early days was something that Ross said fairly early in his trading courses. While explaining the basics of his trade strategy, he casually mentions that his daily trading strategy doesn’t include short trade strategies. He explains that he believes the market (generally speaking) is long-biased, meaning that short trends don’t tend to be sustained for long. A quick glance at most financial asset charts will show that price tends to continue up over time, rarely ever going back to zero. Of course, this isn’t a hard science, and there are always exceptions, but as a general idea, this seems sound.

As I continued learning and finding my trading style, I noticed some things about my trading. I was more successful with long trades. I was below 50% accurate on my short trades, and of those I was correct with, they generated less of a return than my long trades did. This is very anecdotal, but it led me to stop taking short trades. Now, I seldomly take shorts and my trading game has improved a bit.

Moving forward, I started looking at automated strategies and strategy research. This led me down a rabbit hole (one that HGT came out of), and I really started to see this same pattern when backtesting trade systems. Long trades always seemed to perform better than shorts. That leads me to this question: is the market actually long-biased in this way? I still need to get a method of quantifying this idea, but if you look at a simple buy-and-hold strategy (pick an asset) and plot the equity, you usually see a price increase over time. Don’t you wish you had bought and held Apple stock in the early 2000s?

This idea that the market tends to be long-biased has led me to look at trading strategies through two lenses. Just because a signal works well for long trades, it doesn’t mean that the opposite signal will succeed for shorts. This means I need to look at short strategies differently than long ones.

I plan to continue researching indicators and testing simple strategies using those indicators. For the time being, most of these strategies will be long-only systems. During the process, I will attempt to develop a system for creating short strategies. I believe that short strategies will need more finesse and tighter trading constraints to work effectively.

Now that we have story time out of the way let’s look at some of the backtest results we got from this test. We will then jump into the rules for this strategy and the Pine Script code used for this test.

Backtest Results

This strategy was tested on several different assets (SPY, ES (futures), and BTC/USDT). I used daily data for each one and did not optimize the indicator values. The strategy only uses a simple static stop and exits trades based on another signal generated from the same indicator. This means that there are fewer trades than one might see on an intraday strategy.

Addendum: The MACD indicator used in this strategy is a custom MACD. The Python code and concept for the indicator can be found in the link below. I converted it to Pine Script for this test, so the indicator is built inside the strategy code. It would be usable on the platform if they hadn’t taken it down for “breaking house rules.”

All testing and photos come from the TradingView platform.

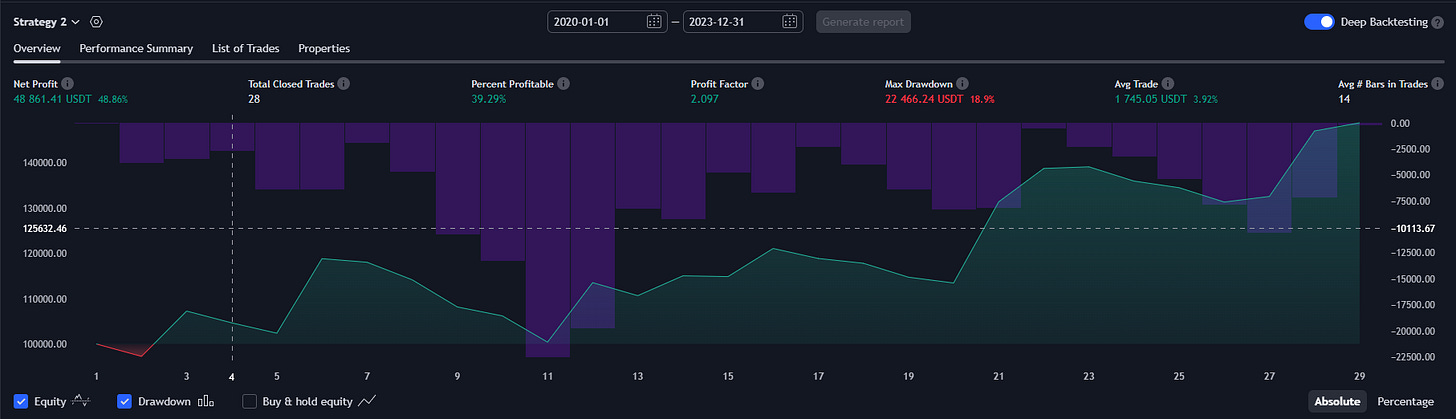

Out-of-sample (OS) dates: 01/01/2020 - 12/31/2023

In-sample (IS) dates: 01/01/2024 - 05/21/2024

SPY IS Results:

SPY OS Results:

ES IS Results:

ES OS Results: For some reason, when I ran this test on the OS data, it didn’t generate any trades in the backtest. When I included the dates in the entire sample, it generates several. So, I have just added the entire data set test here for reference.

BTC/USDT IS Results:

BTC/USDT OS Results:

You can see that it generates very few trades and tends to stay in the trades for a week or more on average. The equity curves could be better, and the drawdown could use work. Again, this aims to test this particular signal on daily data and see if there is anything there. As I go forward, we will continuously add to these strategies, making them more applicable for intraday strategies or more robust for swing trades.

The rest of this post is for paid subscribers. Paid subscribers will have access to the private GitHub where all the Hunt Gather Code and strategies live. It is continuously being worked on and will expand as we explore the world of automated trade systems.