Strategy 9 -- An NDX rotational momentum strategy

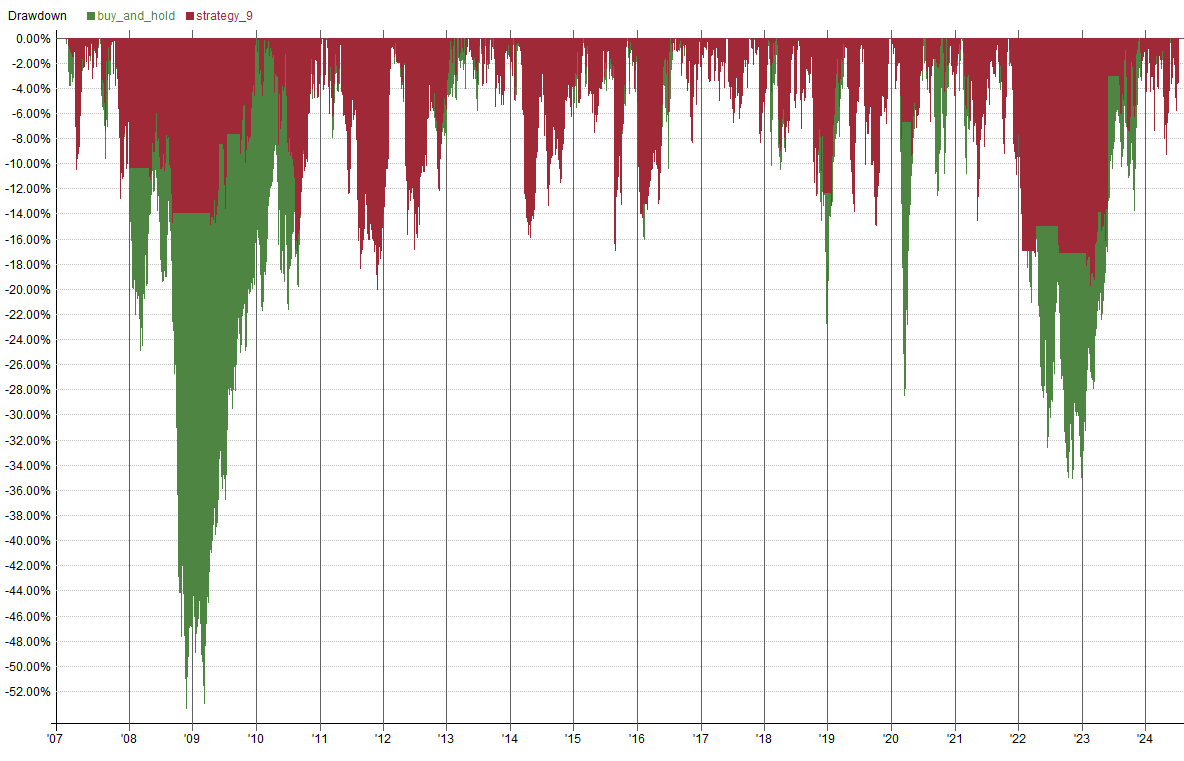

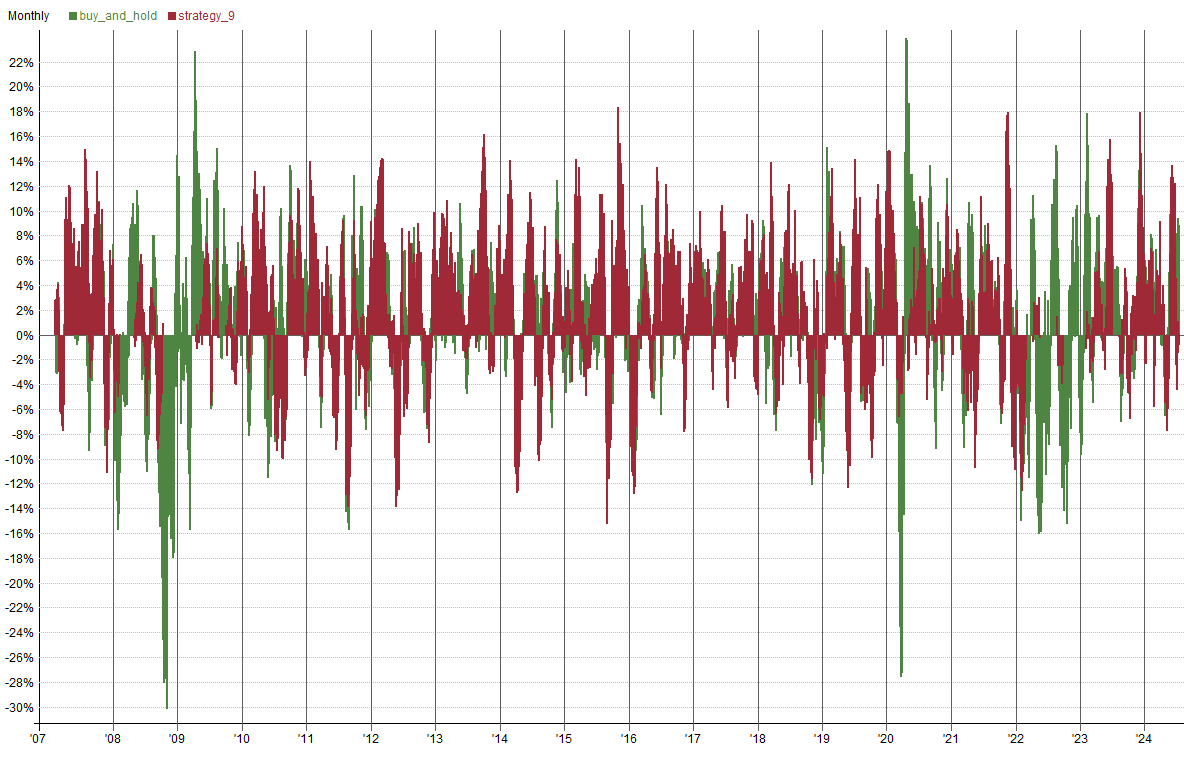

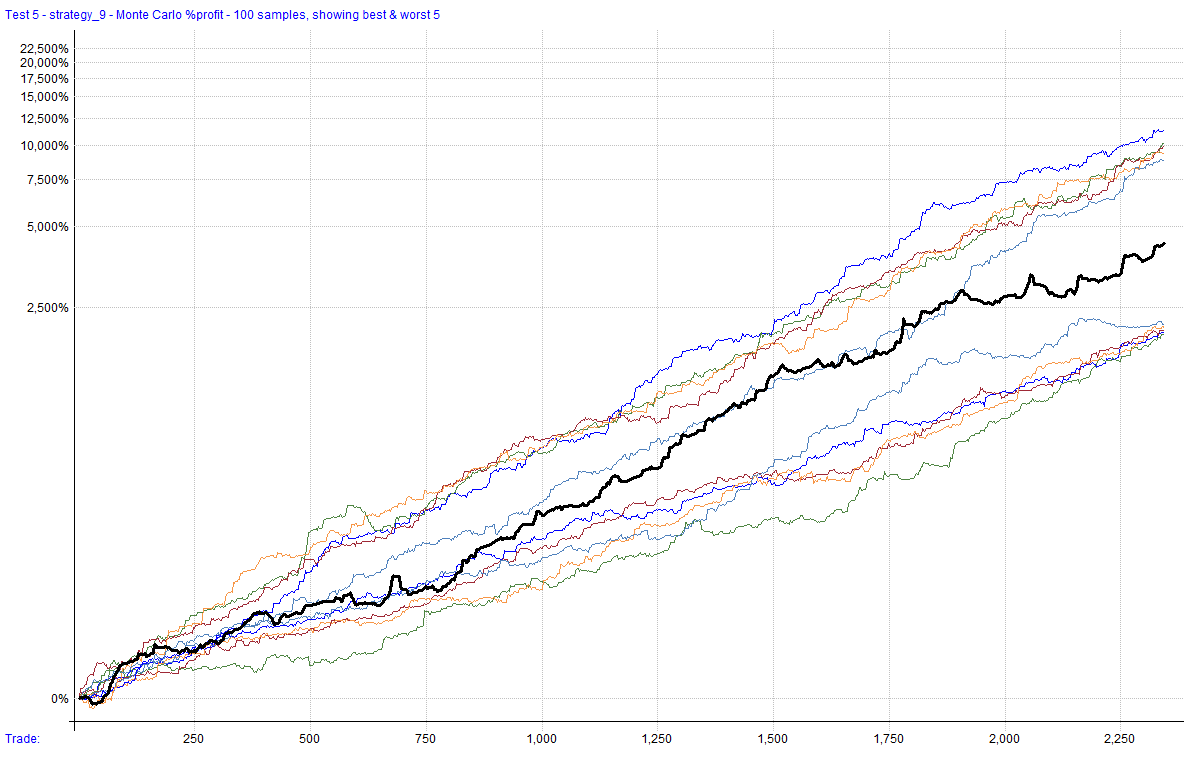

This strategy captures trending stocks and uses volatility adjusted sizing techniques with dynamic weekly rebalancing to produce a CAR of 22%, MaxDD of 20%, PF of 2, and a Sharpe of 1.2.

Disclaimer: the following post is an organized representation of my research and project notes. It doesn’t represent any type of advice, financial or otherwise. Its purpose is to be informative and educational. Backtest results are based on historical data, not real-time data. There is no guarantee that these hypothetical results will continue in the future. Day trading is extremely risky, and I do not suggest running any of these strategies live.

It's August, and the first strategy for the month is here. In this one, we go back to equities trading and look at rotational momentum strategies. A rotational momentum strategy is one that measures and ranks stocks inside of a universe (usually an index constituency) and attempts to trade the stocks that are the strongest. They typically rebalance on a set schedule (monthly, quarterly, etc). In this version, stocks are ranked with a custom relative strength calculation. Risk is managed with regime filters, volatility driven position sizing and local trend checks.

Before we get into the strategy, I want to discuss an idea that I am toying with. Think about Strategy 4 and it's updated successors. I am considering that as I update strategies, I will make the depreciated versions available to the free readers. They would be updated to show that they are depreciated and that there were errors (or just major improvements) in the strategy that led to the depreciation. It may seem like they may be of no use to anyone if they are depreciated (or if they had errors), but it isn't impossible to look at the strategy, determine what is wrong with it on your own (or with a friend), and update it yourself to suit your needs and trading style.

Also, I have been experimenting with streamlining my workflow and automating any tasks that I can. I recently discovered that RealTest has a command line feature that will allow me to create some handy automation scripts using Python (or something else?). I look forward to automating backtests and scans and then sending the results somewhere cool.

On to the matter at hand.

Strategy 9

NDX Rotational Momentum Strategy

This strategy utilizes dynamic sizing and a weekly rebalance to capture momentum in the Nasdaq 100, leveraging trend direction, market conditions, and liquidity filters to manage trades.

Strategy Features:

Rotational Momentum Strategy (long only)

Trades stocks on the Nasdaq 100

Weekly rebalance

Uses a regime filter and liquidity checks for protection against adverse market conditions

Stocks ranked by relative strength

Risk adjusted for volatility and tolerance level

Max 5 positions

Key Metrics: Key metrics are from the latest backtest date in the date range above in the test settings.

Compound Annual Return: 22%

Max Historical Drawdown: 20%

Average Holding Period: 25 Days

Expectancy Per Trade: 5.49%**

Win Rate: 62%

Profit Factor: 2.03

Sharpe Ratio: 1.21

MAR Ratio: 1.10

Data Source and Test Settings: For transparency.

Data Source: Norgate

Universe: Nasdaq 100 Constituents (current & past for testing)

Benchmark: QQQ

Date Range: 01/01/2007 to 07/12/2024

Bar Size: Daily

Backtesting Platform/Engine: RealTest

Benchmark: This strategy is used to make a comparison to the results of the custom strategy.

Benchmark Strategy: Buy and hold QQQ.

Entry Setup: Enter QQQ.

Exit Rule: Reinvest dividends.

This strategy captures momentum opportunities in the Nasdaq 100 by utilizing dynamic sizing and rebalancing every week. It uses a "custom" relative strength (RS) factor and a linear regression (LR) slope to determine trend direction. The strategy uses a benchmark index fund for benchmark testing and to calculate a regime filter based on drawdown, while Average True Range (ATR) manages position sizing (risk). Stocks are ranked for trade selection by their RS factor.

Strategy Results

Summary Stats

Combined Monthly Percent Gains

Graphs

Trade Plots

Monte Carlo Analysis

Strategy Details

The rest of this post is for paid subscribers. Paid subscribers will have access to the private GitHub where all the Hunt Gather Trade code and strategies live. It is continuously being worked on and will expand as we explore the world of automated trade systems.